How to Reply to GST Notice Online: A Comprehensive Guide

Posted By: Admin Published: 21-05-2025

Receiving a GST notice can be a daunting experience for any business owner. However, responding promptly and accurately is crucial to ensure compliance and avoid penalties. This comprehensive guide will walk you through the process of replying to a GST notice online, with insights from Tripathi & Arora Associates, a leading consultancy in Delhi NCR.

Understanding GST Notices

What is a GST Notice?

A GST notice is a formal communication issued by the Goods and Services

Tax (GST) department. It can arise from various situations, such as discrepancies in tax returns, non-compliance issues, or requests for additional information. Notices are typically categorized into:

- Show Cause Notice (SCN): Issued when there are grounds to believe that a taxpayer has violated GST provisions.

- Inspection Notice: Requesting the taxpayer to provide specific documents or information for verification.

- Intimation Notice: Informing the taxpayer about discrepancies in their filed returns.

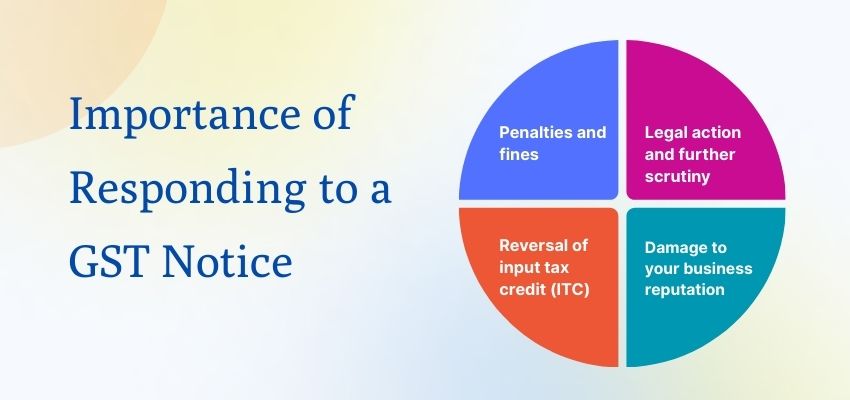

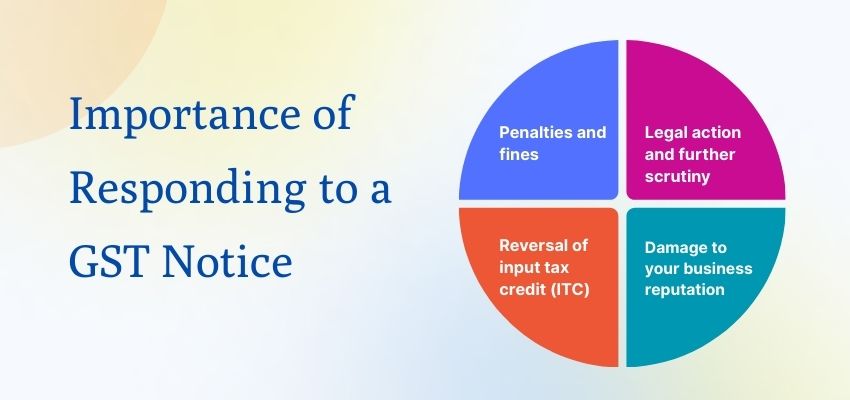

Importance of Responding to a GST Notice

Failing to respond adequately to a GST notice can lead to:

- Penalties and fines.

- Legal action and further scrutiny.

- Reversal of input tax credit (ITC).

- Damage to your business reputation.

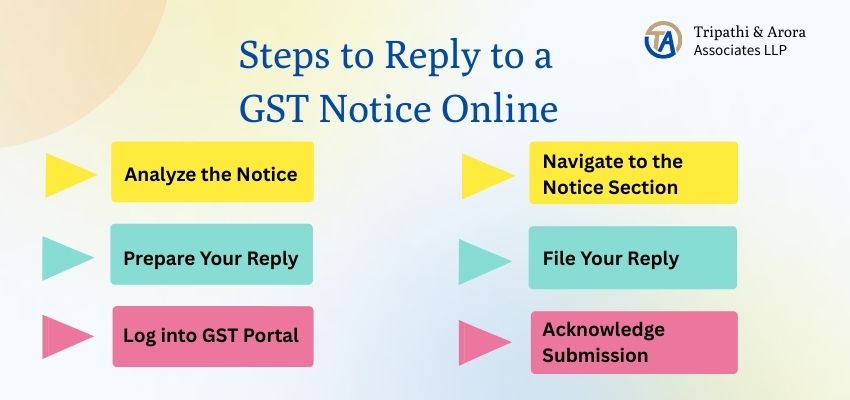

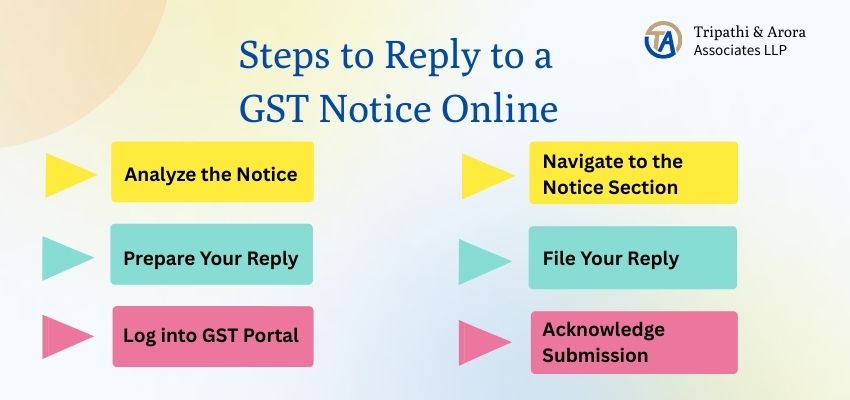

Steps to Reply to a GST Notice Online

Recommended:

GST Slabs in India

Step 1: Analyze the Notice

- Read the Notice Carefully:

- Identify the type of notice received.

- Understand the specific issues raised by the tax officer.

- Gather Relevant Documents:

- Collect all necessary documents related to the notice, such as tax returns, invoices, and payment receipts.

- Identify the Deadlines:

- Note the timeline specified in the notice for submitting your reply.

Step 2: Prepare Your Reply

- Draft a Response:

- Begin with a formal salutation, stating your GST registration number and the notice reference number.

- Clearly address each point raised in the notice.

- Provide Supporting Evidence:

- Attach relevant documents that support your case, such as:

- Sales invoices.

- Purchase receipts.

- Bank statements.

- Use Clear Language:

- Be concise and direct in your responses. Avoid jargon and ensure clarity to facilitate understanding.

Step 3: Log into GST Portal

- Access the GST Portal:

- Login to Your Account:

- Enter your GSTIN, username, and password to log in.

Step 4: Navigate to the Notice Section

- Go to ‘Services’:

- Click on the “Services” tab on the GST portal.

- Select ‘User Services’:

- Under the “User Services” menu, select “View Notices” to access any notices issued against your GSTIN.

- Locate the Relevant Notice:

- Find the notice you are responding to and click on it for further details.

Step 5: File Your Reply

- Select ‘Respond’ Option:

- There will be an option to reply to the notice. Click on “Respond” to initiate your response.

- Upload Your Reply Document:

- Attach the drafted reply and any supporting documents. Ensure that all files are in the required format (PDF, JPG, etc.).

- Submit Your Reply:

- Review the response for accuracy and completeness before submitting. Confirm that all attachments are included.

Step 6: Acknowledge Submission

- Receive Acknowledgment:

- After submission, you will receive an acknowledgment receipt. Save this for your records.

- Follow Up:

- Monitor the GST portal for any updates or further communications from the tax officer.

Tips for a Successful Response

- Be Timely: Submit your reply well before the deadline to demonstrate your willingness to comply.

- Stay Professional: Maintain a professional tone throughout your response.

- Consult a Professional: If the notice is complex, consider seeking assistance from tax professionals or consultants like Tripathi & Arora Associates.

- Keep Records: Maintain a detailed record of all correspondence related to the GST notice for future reference.

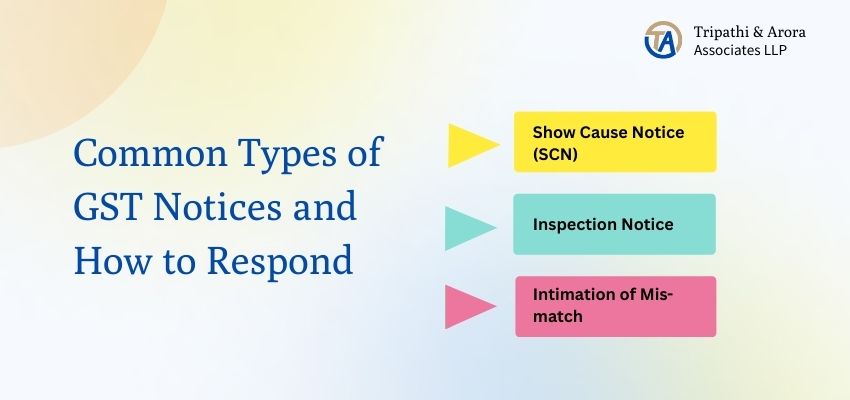

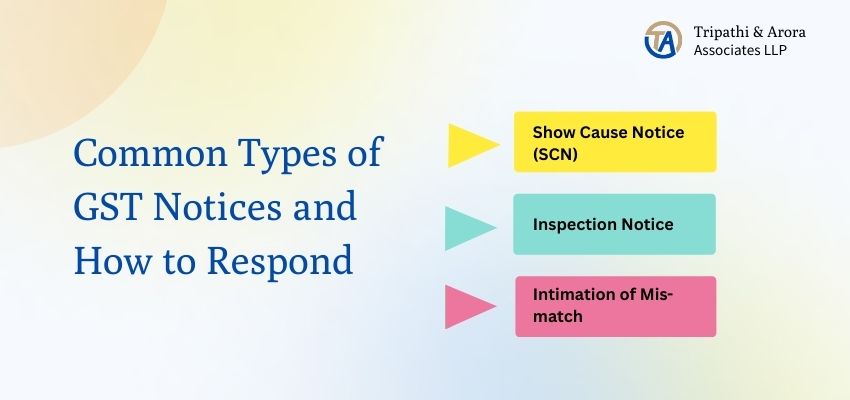

Common Types of GST Notices and How to Respond

1. Show Cause Notice (SCN)

Response Strategy:

- Address the specific violations mentioned in the SCN.

- Provide justifications with supporting documents.

2. Inspection Notice

Response Strategy:

- Prepare to present requested documents during the inspection.

- Ensure all records are organized and readily available.

3. Intimation of Mis-match

Response Strategy:

- Review the discrepancies in detail.

- Respond with clarifications and additional evidence to rectify the mismatch.

Conclusion

Responding to a GST notice online can seem intimidating, but with the right approach, it can be managed effectively. By understanding the notice, preparing a thorough response, and utilizing the GST portal efficiently, you can protect your business from potential penalties and maintain compliance.

For personalized assistance, consider reaching out to Tripathi & Arora Associates in Delhi NCR. Our team of experts is equipped to guide you through the complexities of GST compliance, ensuring that your business remains compliant and well-protected. Contact us today to learn more about our services and how we can assist you in navigating GST challenges successfully.