Section 8 Company Registration in Gurgaon

Posted By: Admin Published: 05-11-2025

- 1. What is a Section 8 Company?

- 2. Scope of Section 8 Company Registration in Gurgaon

- 3. Key Requirements for Section 8 Company Registration

- 4. Step-by-Step Section 8 Company Registration Process in Gurgaon

- 5. 1. Obtain Digital Signature Certificate (DSC)

- 6. 2. Acquire Director Identification Number (DIN)

- 7. 3. Reserve Unique Name

- 8. 4. File for Section 8 License (Form INC-12)

- 9. 5. Obtain Approval and License (Form INC-16)

- 10. 6. File Incorporation Application (SPICe+)

- 11. 7. Certificate of Incorporation – Section 8 Company

- 12. Documents Required for Section 8 Company Registration

- 13. Advantages of Section 8 Company Registration in Gurgaon

- 14. Annual Compliance for Section 8 Company

- 15. EEAT Guidelines in Section 8 Company Registration Content

- 16. Conclusion

- 17. FAQs: Section 8 Company Registration in Gurgaon

- 18. Other Related Links

Section 8 Company Registration in Gurgaon is the go-to structure for NGOs, charitable organizations, and nonprofit entities seeking powerful legal status and full compliance under the Companies Act, 2013.

What is a Section 8 Company?

A Section 8 Company is a not-for-profit organization authorized under Section 8 of the Companies Act, 2013, with the sole objective to promote commerce, art, science, education, research, social welfare, charity, religion, environmental protection, or similar objectives. Profits and income cannot be distributed among members and must be reinvested to achieve the organization’s charitable mission.

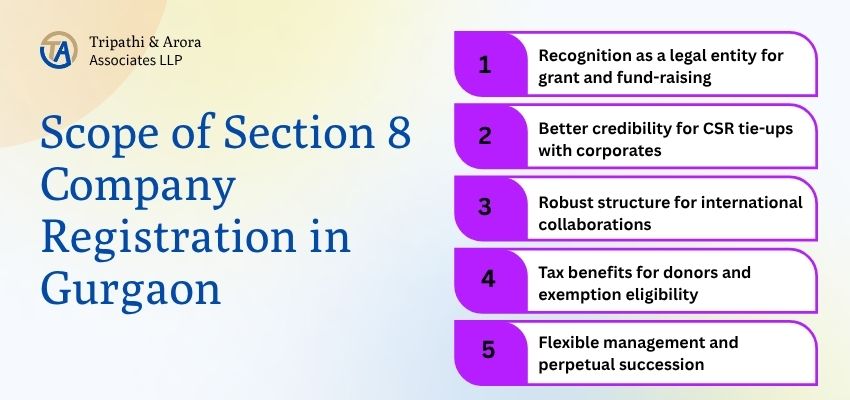

Scope of Section 8 Company Registration in Gurgaon

Gurgaon is a thriving hub for organizations focused on social impact, education, climate initiatives, and cultural development. A Section 8 Company Registration in Gurgaon allows:

-

Recognition as a legal entity for grant and fund-raising

-

Better credibility for CSR tie-ups with corporates

-

Robust structure for international collaborations

-

Tax benefits for donors and exemption eligibility

-

Flexible management and perpetual succession

Tripathi & Arora Associates have assisted numerous NGOs in Gurgaon, delivering streamlined incorporation, regulatory advice, and end-to-end compliance support.

Key Requirements for Section 8 Company Registration

Legal and regulatory needs include:

-

Minimum of 2 directors and 2 shareholders (For Private Limited) or 3 directors and 7 members (For Public Limited).

-

At least 1 resident Indian director.

-

Registered office address in Gurgaon.

-

No prescribed minimum capital, allowing incorporation with any amount.

-

Non-profit charitable objectives and prohibition on dividend distribution.

-

Drafting of Memorandum of Association (MoA) and Articles of Association (AoA) tailored for charitable operations.

-

Application to Ministry of Corporate Affairs (MCA) for license under Section 8.

Step-by-Step Section 8 Company Registration Process in Gurgaon

1. Obtain Digital Signature Certificate (DSC)

All proposed directors must secure DSC from a certified provider to sign digital documents and forms.

2. Acquire Director Identification Number (DIN)

Directors need DIN by submitting Form DIR-3 with relevant identity documents to the MCA.

3. Reserve Unique Name

Submit name reservation via SPICe+ Part A on the MCA portal; name should reflect company type—foundation, council, association, or similar.

4. File for Section 8 License (Form INC-12)

Submit INC-12 with charitable objectives, estimated budget (three years), draft MOA/AOA, and supporting documents to the Registrar of Companies (ROC).

5. Obtain Approval and License (Form INC-16)

After review, ROC issues Section 8 License in Form INC-16, authorizing incorporation.

6. File Incorporation Application (SPICe+)

Submit the SPICe+ form along with all attachments, including license, digital signatures, MOA, AOA, director consent, and address proof.

7. Certificate of Incorporation – Section 8 Company

On successful verification, ROC issues Certificate of Incorporation with unique Company Identification Number (CIN), PAN, and TAN.

Documents Required for Section 8 Company Registration

-

PAN, Aadhaar, Voter ID/Passport of directors and members

-

Photographs of directors

-

Registered office proof (electricity bill, rent agreement, NOC from owner)

-

MOA, AOA drafts

-

Estimated Income & Expenditure statement for three years

-

DIR-2 (director consent)

-

INC-14 and INC-15 declarations

-

Affidavit regarding deposits

Tripathi & Arora Associates conduct a document audit for error-free submission and fast approval.

Advantages of Section 8 Company Registration in Gurgaon

-

No minimum capital required

-

Limited liability for directors and members

-

Perpetual succession structure

-

Tax exemptions (80G, 12A, GST for eligible activities)

-

Eligible for foreign grants (FCRA registration)

-

Credibility with donors, companies, and government agencies

Tripathi & Arora Associates ensure that Section 8 companies get full statutory exemptions and compliance consulting for smooth ongoing operations.

Annual Compliance for Section 8 Company

-

Income Tax Return filing (including 80G/12A compliance where applicable)

-

MCA Annual filings (Form AOC-4, DIR-3 KYC, MGT-7)

-

Maintenance of financial statements and registers

-

Regular reporting of funds, donations, and grant utilization

-

Board meetings, audit requirements, and statutory appointments

EEAT Guidelines in Section 8 Company Registration Content

This guide delivers expertise through Tripathi & Arora Associates’ industry experience, comprehensive coverage of legal regulations, authoritative stepwise processes, and compliance insights. All information is factual and based on current 2025 guidelines to maintain trustworthiness and relevance.

>

>

Conclusion

Section 8 Company Registration in Gurgaon is the ideal structure for nonprofits and NGOs looking for robust compliance, effortless fundraising, and maximum legal protection. Partnering with Tripathi & Arora Associates ensures accurate documentation, expedited approvals, and comprehensive ongoing support for all MCA and tax compliance—making your organization future-ready and impact-driven.

FAQs: Section 8 Company Registration in Gurgaon

Q1. What is a Section 8 Company in Gurgaon?

A Section 8 Company is a non-profit organization—registered with MCA in Gurgaon—focused on charitable work, education, arts, science, or social welfare, where profits are reinvested into the mission.

Q2. How many directors are mandatory for Section 8 Company?

Minimum two for Private Limited, three for Public Limited. One must be a resident Indian.

Q3. Is there any minimum capital requirement?

No, Section 8 Company can be registered without any prescribed share capital.

Q4. Which documents are needed?

Director ID and address proof, photographs, office address proof, income estimate, MOA, AOA, consent forms, and declarations.

Q5. Can Section 8 Company raise foreign funds?

Yes, with FCRA registration and regulatory compliance.

Q6. What is the government’s approval process?

License from the ROC after the submission and verification of forms (INC-12, INC-16); final incorporation with SPICe+.

Q7. How long does the registration take in Gurgaon?

Generally 20-30 working days if documents and application processes are promptly completed.

Q8. What ongoing compliances are there?

Annual filings with MCA, audit, tax returns, and proper maintenance of financial statements.

Q9. What are the major benefits over Trust or Society registration?

Better national recognition, direct regulation by MCA, more credibility for grant, easier multi-state operation, no stamp duty on incorporation.

Q10. Does Tripathi & Arora Associates specialize in Gurgaon Section 8 registrants?

Yes; expert consultants provide start-to-end support for registration, documentation, compliance, and tax exemption for Section 8 Companies in Gurgaon.

Other Related Links

- Incorporation Service

- Private Limited Company Registration

- Limited Liability Partnership Company Registration

- One Person Company Registration

- Partnership Company Registration

- Trademark Registration Service

- Income Tax Return Filing Services

- GST Return Filing Services

- FEMA/FDI Services

- Business Registration Solutions

- Accounting And Taxation Services

- Virtual CFO Services

- Secreterial Compliances Services

- Drafting Services